Economic tremors are shaking two major players on the global stage: Japan and the United Kingdom. Japan, the world's third-largest economy, has unexpectedly slipped into recession. This downturn follows two consecutive quarters of contraction in gross domestic product (GDP), falling 0.4% in the October-December 2023 period.

For the UK, the situation is similar, which entered a recession towards the end of 2023. Its GDP shrank by 0.3%, following the decline in quarter three as well.

This fulfills the technical definition of a recession (two consecutive quarters of negative growth).

The news raises eyebrows about whether Rishi Sunaik has met his pledge to grow the economy, which was among the five key promises Sunaik made in 2023.

Through this article, we will analyze the economic situation of both nations and explore if other nations might face similar troubles.

Japan's Confirmed Slide:

In late 2023, Japan slipped into a technical recession, marked by two consecutive quarters of negative GDP growth. Several factors have conspired to create this situation, each leaving its mark on the nation's financial landscape. Japan's towering public debt of ¥1,216 trillion (US$11.1 trillion) looms large, which is the highest burden among developed nations at 236% of GDP.

Low tax revenue, a product of a culture averse to high taxation and a shrinking working-age population, has limited the government's ability to generate income. On the other hand, rising social security costs, driven by an aging population and generous benefits, have placed a constant strain on the national purse. Economic stimulus efforts, particularly in the wake of recessions and slow economic growth, have further added to the national debt, which is seen as a necessary evil to jumpstart the economy.

Beyond these homegrown options, the recession in Japan finds fuel in external factors as well. Weak domestic demand has crimped growth, while a sluggish global economy further dampens export opportunities. The Yen’s depreciation, although benefits exporters, simultaneously inflates the cost of goods imported. This pressurizes people and businesses alike.

As we peer into 2024, economists predict continuation of the recession this year as well.

UK Recession:

In the fourth quarter of 2023, UK witnessed shrinking GDP (-0.3%), much like the previous quarter (-0.1% in Q3), entering recession officially. While not as dramatic as the 2009 crash, the 0.3% GDP contraction in Q4 paints a worrying picture.

In 2009, the economy dropped steeply. Fortunately, the same is not the case today. This recession has more prolonged stagnation. The growth will tether to almost zero for the entire year, economists predict.

The news comes ahead of Chancellor Jeremy Hunt's upcoming budget announcement on March 6th. The recession puts pressure on Hunt to deliver measures that stimulate the economy, alleviate cost-of-living burdens, and boost public confidence. Failing to do so could hurt the Conservatives' chances in upcoming elections. Now, Hunt's budget announcement will be closely watched as a crucial response to the UK's economic challenges.

While some economists downplay the severity of this "mild" recession, the broader impact is undeniable.

The recession in UK is a mix of various factors. The lingering effects of the pandemic, eroding confidence amid post-Brexit tensions between UK and EU, and the effects of Russian invasion of Ukraine are few factors to blame.

These impacted trade, the manufacturing sector, construction, shops, and even restaurants and hotels, pushing on unemployment and inflation.

Amid this, the government and the Bank of England have sorted to pump money into the economy and lower the interest rates. Economists believe this might do the trick and push UK out of economic uncertainty.

However, the surprising thing is that Japan, before recession, was third largest economy and UK is the sixth-largest global economy. So, is it likely that we are on the brink of facing global recession?

The Chances of Global Recession:

When it comes to predicting global recession, economists have differing opinions. On the one hand, The World Bank, the International Monetary Fund, and TD Securities predict a looming year, The World Economic Forum and The Guardian seem optimistic.

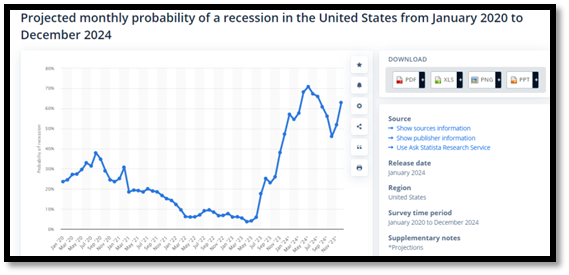

As per Statista, the possibility of the US falling into recession by the end of this year is solid 63%.

Although IMF has increased the global economic growth projection from 2.9% in 2023 to 3.1% in 2024, the growth will mostly be contributed by emerging markets. The growth in developed nations is expected to be slow, if not at all.

So, while developed economics might struggle to scale up growth, developing nations face a positive outlook for 2024.

Growth Opportunities for Developing Nations:

As per the data of the IMF, the economic slowdown in Europe will benefit developing nations such as India. World Economic Forum predicts that India will grow at the rate of 6.5% in fiscal year 2024, making it as one of the fastest-growing economies in the world.

Conclusion:

The developed economies such as the US and China are expected to fall into recession. For the developing economies, such as India, 2024 holds growth projections. This is the time for developing economies to shine amid developed economies struggle to pick up pace.

Copyright © 2026 getessayservice.com