Why it is important: India is the top producer of milk in the world. And notably, Amul and Nandini are India's top two dairy brands. Recently, Amul announced the sale of milk and curd in Karnataka, which dominates Nandini’s market. So keeping aside the political debacle, will Amul take over Karnataka’s market, or will Nandini hold the ground? Let’s look at their numbers and market data to find out.

Introduction:

Milk is an elixir. It is the only source of infant nutrition, yet it does not disappoint in its nutritional value. From treating illness to building bone strength, milk is undoubtedly the king of all liquid nutrients. Hence, milk and its related dairy products are part of every culture and tradition. However, it finds great importance in Asian culture, especially in India.

In India, the cow- the ultimate source of milk- is worshipped like a goddess. From a very young age, milk is the prime component of the Indian diet. The milk-drinking trend has been dominatingly imbibed in Indian culture for ages.

That is why India is the leading milk producer worldwide, contributing 24% to global milk production. Today, India has 765 dairy companies out of 45000 dairy brands worldwide.

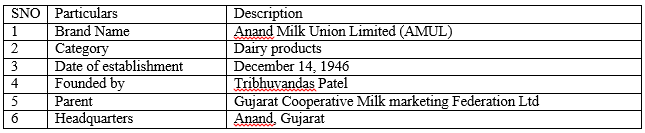

And the leading player in the largest milk market, India, is Anand Milk Union Limited, popularly known as Amul. Amul is the Gujarat state government’s cooperative society, officially named the Gujarat Milk Marketing Federation (GMMK). The company was established just a year after the independence of India. Since then, the company has grown exuberantly to such an extent that its annual revenue stood at $6.5 billion last year.

Amul is the most soughed brand in northern India but is not dominant in southern parts. So, hoping to expand the brands’ reach, Amul announced to penetrate the southern State of Karnataka on 5th April this year.

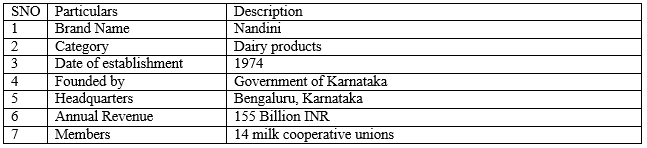

However, like Gujarat’s state government has Amul under its milk federation, Karnataka has the Nandini brand under Karnataka Milk Federation (KMF). Nandini is a homogeneous dairy product manufacturing company with a well-established market in over 28,000 villages through 15,000 cooperative societies.

The announcement has sparked a debacle in the country. Domestic hotels in Karnataka are unanimously abolishing the use of Amul. Hashtags to ‘ban Amul’ and ‘save Nandini’ are also surfacing on the social media platform- Twitter.

The announcement has also started a fight of words in the Indian political ecosystem.

But in this case study, keeping aside the political debacle, we will analyze how recent controversy will impact Amul’s reputation and market reach to determine whether Amul will vanish the existing brands in new markets or if Nandini will hold its ground in Karnataka.

Company Profile:

Amul:

Amul is the king of dairy in India. The brand that initiated the white revolution in India began with a small union in Anand, Gujarat. The union was established by Tribhuvandas Patel back on December 14, 1946, to prevent the exploitation of local farmers by vendors and agents.

The Union was founded under the guidance of Sardar Vallabhbhai Patel, India's first deputy prime minister. Today, Amul collects more than 23 million litres of milk daily, generating annual revenue of over US $6.5 Billion.

Nandini:

On the one hand, Amul is the dairy king of India; on the other, Nandini is the dairy queen of South India. Nandini is the well-known Karnataka Milk Federation brand, established in 1974. As per Statista, Nandini is the second-largest milk brand in India.

What sparked controversy in the first place?

The controversy began in December when Amit Shah, Minister of Co-operation, announced that Amul and Nandini would enhance primary dairy's reach in every Karnataka village.

The move was perceived as a direct attempt to overtake Nandini’s market; hence save Nandini campaign was initiated.

Following the online campaign, on 5th April, Amul dropped a hint of entering Bengaluru on a Twitter post.

The post soon went viral. And within no time, political leaders and media were neck-deep in talks about Amul replacing Bengaluru’s homogeneous brand, Nandini.

Hashtags #gobackamul and #savenandini became trending topics countrywide. The controversy soon became a political debacle involving the ruling and opposition party.

Amul clarifies its stance:

After the previous announcement of Amul sparked a row, Amul’s chief Jayen Mehta clarified that Amul plans to sell milk and curd in Bengaluru only, not the entire state. Additionally, the plan is to sell online and not in retail stores. He added that Amul already sells milk and curd in two districts of Karnataka.

And now that the stance of Amul is clear let us look at its impact on the market.

How Amul’s entrance in Karnataka will impact the brand?

The price comparison:

In Bengaluru, the cost of one litre of Amul milk is INR 54, whereas the same quantity from Nandini costs INR 43. The huge price gap is accounted for by governmental subsidy on Nandini milk.

Hotels in Bengaluru are standing against Amul:

Hotels in Bengaluru stand firm against Amul. C. Rao, president of the Bruhat Bengaluru Hoteliers’ Association (BBHA), stated that all the hotels of Bengaluru unanimously support its indigenous brand, Nandini. Hence, a decision to ban Amul products in all hotels has also come forward.

Amul is bigger than Nandini:

Amul is a well-established brand that exports milk and products to over twenty international locations. It is also the biggest dairy exporter in India.

Amul undoubtedly has a larger market influence and product range than Nandini, an indigenous brand. However, one of the biggest advantages of Nandini is its affordable price and understanding of local market dynamics.

But both have the same goal:

Despite encircling conspiracy, one thing that binds the brands is their goals. Both are government unions working towards preventing the exploitation of poor farmers.

Be it Amul or Nandini, speaking up for locals has been the prime motive of both brands.

Are Amul and Nandini rivals:

No. Amul and Nandini are not rivals. Although the debate has attracted much political attention, both brands are “made of farmers, to the farmers”. In terms of market dominance, Amul has the upper hand; however, in the particular case of Karnataka, Nandini has a bigger customer base. Additionally, the Save Nandani campaign has also garnished patriotism for Nandini.

Also, considering the presence of Amul in two districts of Karnataka did not dominate Nandini because of its price point and massive customer base, it would be safe to say that both the brands are not up for competition but are striving for the same goal- supporting farmers.

The final thoughts:

The controversy of Amul destroying Nandini has taken the shape of political warfare. However, speaking from the experience of Amul in Karnataka, Amul cannot establish a stronger market in Bengaluru because of Nandini’s affordability, well-established market connection, and favouritism from the state government.

"Struggling with term papers? Our writers at BEWS can help turn your struggles into success."

Copyright © 2026 getessayservice.com